Simple depreciation calculator

In other words the. You probably know that the value of a vehicle drops.

Free Macrs Depreciation Calculator For Excel

A calculator to quickly and easily determine the appreciation or depreciation of an asset.

. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Also includes a specialized real estate property calculator. Straight line depreciation calculator.

How Simple Interest Works In This Calculator. It provides a couple different methods of depreciation. This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used.

This depreciation calculator is for calculating the depreciation schedule of an asset. The following methods are used. Period Period may be in Years Or Months.

Where Di is the depreciation in year i. Depreciation Calculator Pro has been fully updated to comply with the changes made by the Tax Cuts and Jobs Act TCJA legislation that affect the calculation of fixed asset depreciation. The calculator allows you to use.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. It is fairly simple to use. The MACRS Depreciation Calculator uses the following basic formula.

The first step to figuring out the depreciation rate is to add up all the digits in the number seven. Percentage Declining Balance Depreciation Calculator. Select your Base Currency that you want to quote against.

Using the formula for simple decay and the observed pattern in the calculation above we obtain the following formula for compound decay. Next youll divide each years digit by the sum. A P1 in.

All you need to do is. 7 6 5 4 3 2 1 28. C is the original purchase price or basis of an asset.

Also known as a Percentage Depreciation Calculator the Declining Balance Depreciation Calculator provides visability of a declining balance depreciation is where an asset loses value. Select your Quote Currency. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle. Rental property depreciation calculator. This calculator may be.

MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. These are set at 1 base currency unit. Simple growth 10 of 100.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. First one can choose the straight line method of. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and.

For example if you have an asset. A book value or depreciated. The calculator also estimates the first year and the total vehicle depreciation.

Select the currency from the drop-down list optional Enter the. Simple and Compound Calculator Appreciation Depreciation. D i C R i.

Enter your starting quote exchange rate 1. Business vehicle depreciation calculator. Uses mid month convention and straight-line.

Declining Balance Depreciation Double Entry Bookkeeping

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator

Depreciation Formula Examples With Excel Template

Method To Get Straight Line Depreciation Formula Bench Accounting

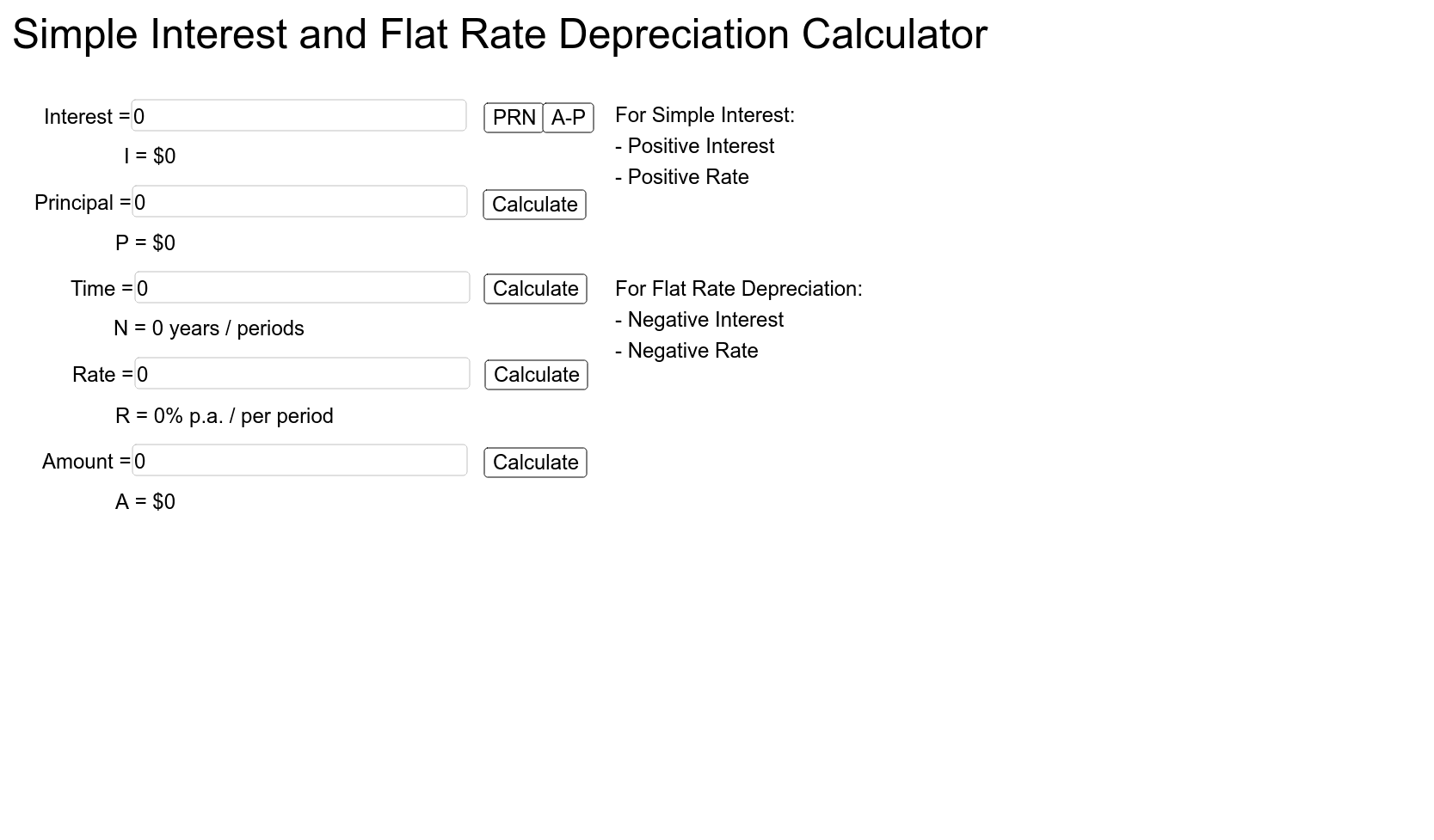

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Straight Line Depreciation Formula And Calculation Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

Macrs Depreciation Calculator With Formula Nerd Counter

Sum Of Years Digits Depreciation Concept Formulas Solved Problem Pmp Exam Youtube

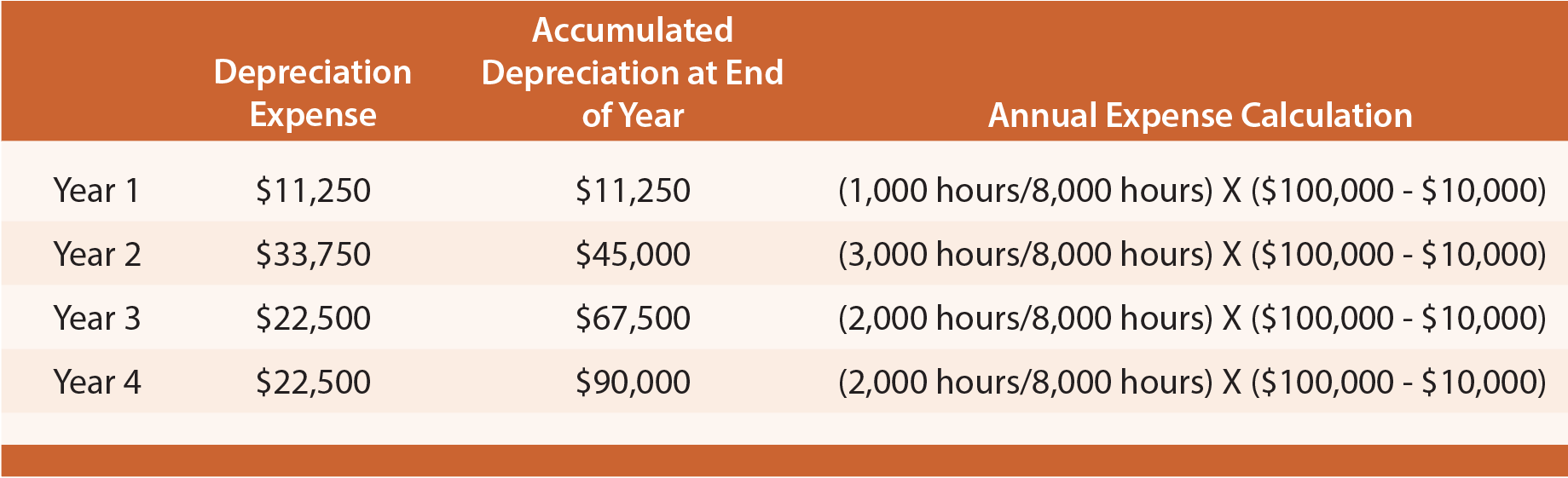

Depreciation Methods Principlesofaccounting Com

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Daily Business

Depreciation Formula Calculate Depreciation Expense

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition